Introduction to the 721 Exchange

Published on Nov. 11, 2011

1. Benefits of a 721 Exchange

2. Qualification for a 721 Exchange

3. Putting it All Together: How a 721 Exchange Works

4. End of the 1031 Exchange Road

Investors seeking to defer capital gains taxes while increasing diversification in real estate should consider utilizing a 721 exchange. Section 721 of the Internal Revenue Code allows an investor to exchange property held for investment or business purposes for shares in a Real Estate Investment Trust (REIT) without triggering a taxable event. The transaction allows investors to increase the liquidity and diversification of their real estate investments while deferring costly capital gains and depreciation recapture taxes that may result from the sale of a property.

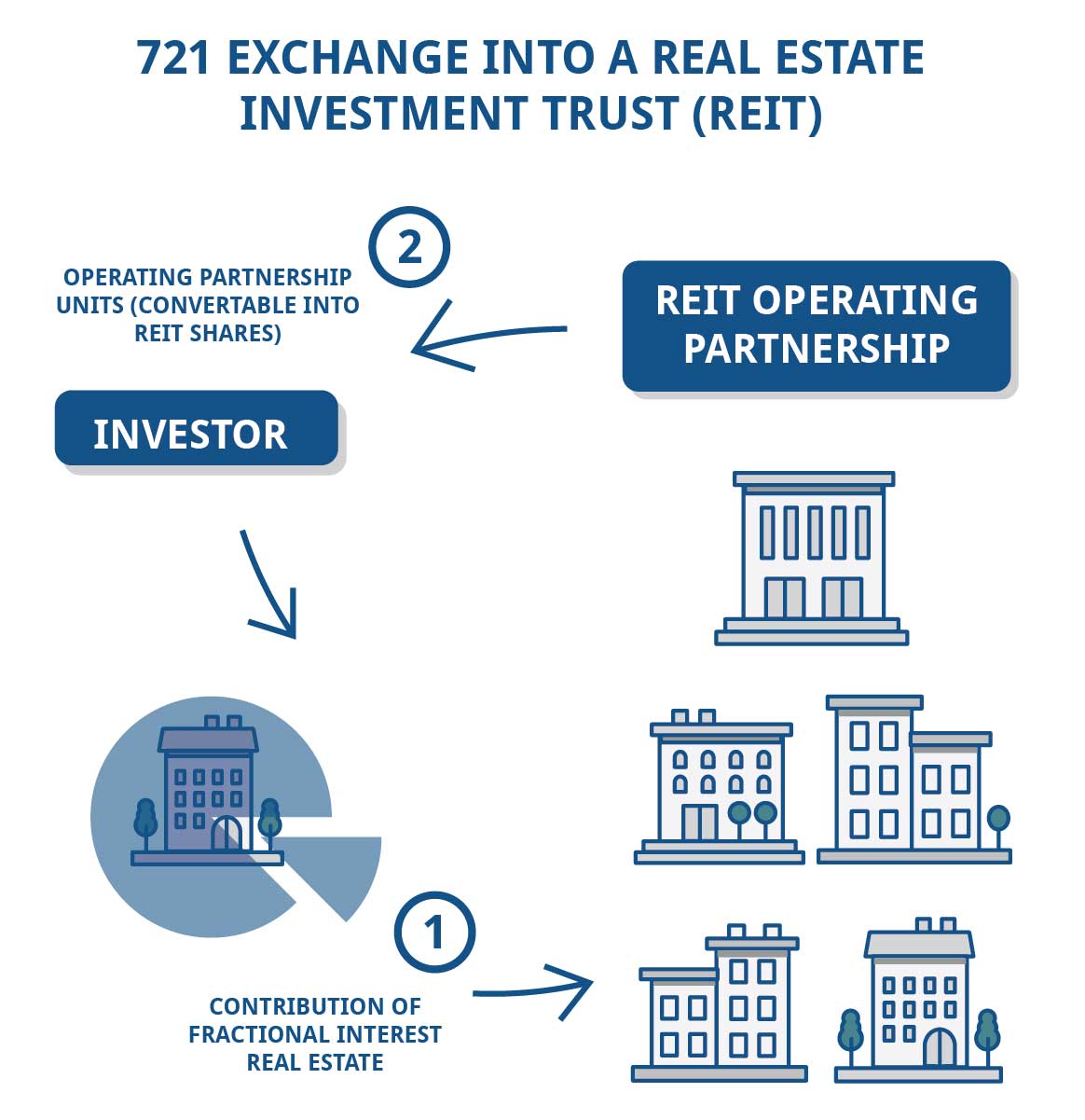

Many REITs utilize section 721 as a method to acquire property from investors who are interested in selling their investment real estate but do not want to find a replacement property as part of a 1031 exchange or pay capital gains taxes. Rather than exchanging property for another property, an investor can utilize section 721 to contribute property directly to a REIT's operating partnership (the entity through which the REIT acquires and owns its properties) in exchange for operating partnership units. This transaction is often called a "721" or an "UPREIT" exchange.

Benefits of a 721 Exchange

Taxes: In a typical property sale, the seller would pay taxes on the capital gains realized as well as the depreciation that was utilized to defer taxes on the property's income. The capital gains and depreciation recapture taxes could exceed 20-30% of the gains realized upon sale, leaving the investor with less capital for reinvestment. A 721 exchange allows investors to avoid taxes and keep their wealth working for them in a tax- deferred exchange of their investment property for shares in a REIT. REITs are required to distribute 90% of their taxable income in the form of dividends paid to shareholders. Dividends are declared annually by the REIT and typically are distributed monthly or quarterly.

Taxes: In a typical property sale, the seller would pay taxes on the capital gains realized as well as the depreciation that was utilized to defer taxes on the property's income. The capital gains and depreciation recapture taxes could exceed 20-30% of the gains realized upon sale, leaving the investor with less capital for reinvestment. A 721 exchange allows investors to avoid taxes and keep their wealth working for them in a tax- deferred exchange of their investment property for shares in a REIT. REITs are required to distribute 90% of their taxable income in the form of dividends paid to shareholders. Dividends are declared annually by the REIT and typically are distributed monthly or quarterly.

Diversification: The 721 exchange enables an investor to achieve diversification across geography, industry, tenant, and asset class in a REIT structure. As a shareholder in the REIT, the individual investor participates in a diversified portfolio of real estate and is no longer concentrated and dependent on one asset to provide cash flow and appreciation. REITs also can provide the same ongoing benefits of real estate ownership including income, depreciation tax shelter, principal pay down, and appreciation. Many REITs continue to make acquisitions on an ongoing basis. This allows the investor to benefit from future buying opportunities in the REIT without triggering any capital gains or depreciation recapture tax events.

Estate Planning: The 721 exchange often is utilized as an estate planning tool to prepare an investor's real estate assets to be passed down to heirs. When direct real estate assets are passed to heirs they are often difficult to quickly liquidate and equally divide among heirs. Conflict may arise as to how or when assets are to be sold, and this can create other estate issues for the heirs. The 721 exchange provides a tailored solution that allows the estate to be prepared for easy transfer while deferring the capital gains taxes that have built up over the years.

Estate Planning: The 721 exchange often is utilized as an estate planning tool to prepare an investor's real estate assets to be passed down to heirs. When direct real estate assets are passed to heirs they are often difficult to quickly liquidate and equally divide among heirs. Conflict may arise as to how or when assets are to be sold, and this can create other estate issues for the heirs. The 721 exchange provides a tailored solution that allows the estate to be prepared for easy transfer while deferring the capital gains taxes that have built up over the years.

Before death and the passing down of the estate to heirs, the individual investor continues to receive dividend income. Instead of individual real estate assets, the heirs can receive easily divisible shares in a REIT that can be much more easily liquidated upon passing of the estate. Heirs who do not want or need funds may continue to hold shares in the REIT and receive the dividends. Regardless of the decision of the heirs, heirs receive a step up in basis that permanently removes all capital gains and depreciation recapture taxes deferred in the estate. Beyond the estate planning benefits, the divisibility and liquidity of REIT shares allow investors to easily sell some of their shares if they are in need of capital.

Passive: The 721 exchange allows an individual investor to trade an actively managed real estate asset for a portfolio of real estate assets that are actively managed by the principals of a Real Estate Investment Trust. REITs allow individual investors to access and rely upon expertise provided by institutional asset management firms for all decisions regarding the real estate portfolio. REITs are passive investments, structured to provide acquisitions, property management, dispositions, investor communication, and the distribution of investors' income produced from the portfolio.

Qualification for a 721 Exchange

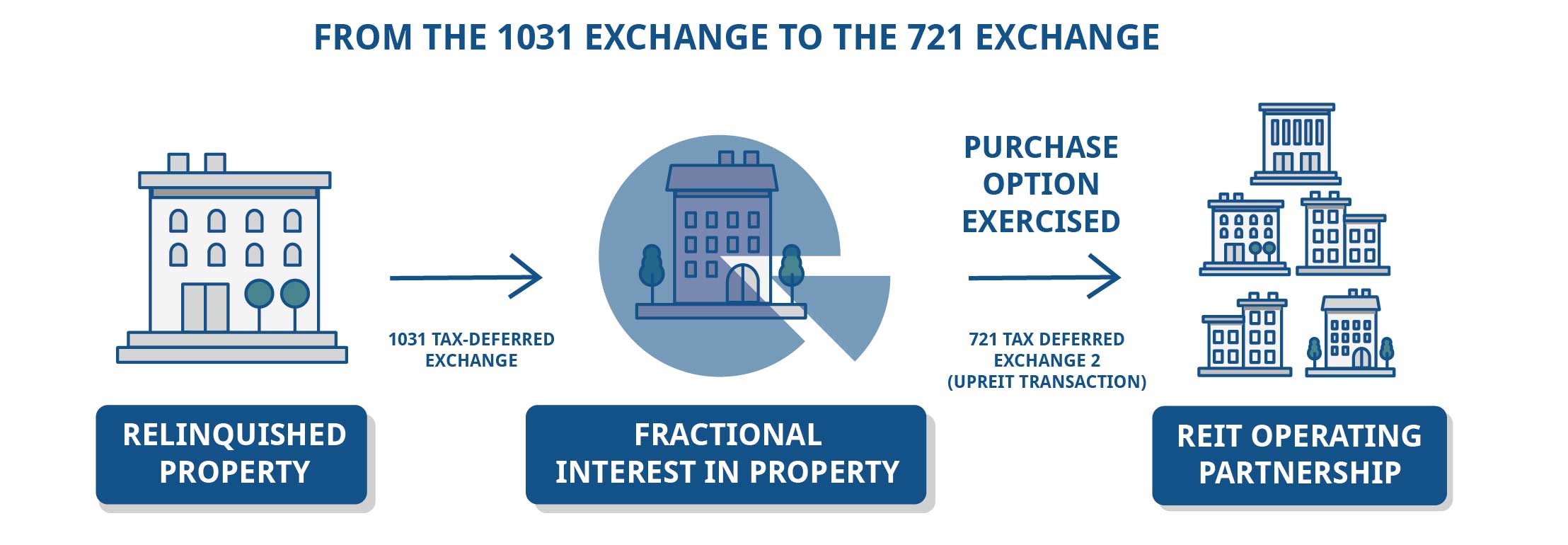

In order for an investor to contribute a property to a REIT through an UPREIT transaction, the property must meet the REIT's investment criteria. Typically, most REITs target and require investments in institutional-grade real estate. Few individual investors own this type of property and therefore are not able to directly contribute a property to a REIT through a 721 exchange. However, by utilizing a 1031 exchange, an individual investor can exchange a property that does not meet a REIT's criteria for a fractional interest in a high-quality institutional-grade property. An investor then may have the opportunity to contribute that fractional interest to a REIT in a tax-deferred 721 exchange.

Putting it All Together: How a 721 Exchange Works

There are several real estate firms that facilitate the combination of the 1031 and 721 exchanges, allowing individual investors to access UPREIT transactions. For example, an investor can sell his investment or business property, (termed the "relinquished property") and, following the 1031 exchange rules, acquire another "like kind" property of similar or greater value. This "replacement property" is used as a rental or business investment property for approximately 12 to 24 months, demonstrating the investor's intent to hold it, thus qualifying for 1031 capital gains tax deferral. Then, the investor can "contribute" the "replacement property" to a REIT in exchange for the REIT's operating partnership units (OP units), which then are exchanged directly for shares in the REIT.

End of the 1031 Exchange Road

Since REIT shares cannot be utilized in a 1031 exchange, the funds utilized in a 721 exchange transaction cannot be used in a future 1031 exchange. If shares in the REIT are sold, or if the REIT sells its properties and returns the capital gains back to investors, a taxable event would occur.