The Battle of the Flations

Published on July 21, 2009

As we traverse these difficult economic times together, and as many of you have requested of us, we are endeavoring to make our research and analyses of the macroeconomic direction available on a regular basis. We hope that this economically focused newsletter (of which this is the first issue) can serve as just one more way we can help equip you for these unique economic circumstances.

Deflation or Inflation? It makes a big difference to you.

Many of the most intelligent and prominent economists in the world recently are grappling over what kind of "flation” we will face next in this ongoing economic crisis. Will it be deflation or inflation? Initially, this question may seem like a mere academic exercise, offering little in the way of practical value for you and your portfolio. However, getting the right answer to this particular question and preparing accordingly can make a substantial difference to you and your portfolio over the next several years.

The fact is that both inflation and deflation can have a devastating impact on your wealth, but the ways in which they can affect you are completely different. Therefore, it is essential to understand which "flation” we may be facing. In this first issue of the newsletter, I will attempt to define the terms of and lay out the evidence for both sides of the inflation/deflation argument. Then, I will wrap up with our current view of what may be coming down the road.

The Bottom Line

For those of you who are more interested in the bottom line than the arguments that get us there: We believe that we will be facing an economic phenomenon that is a bit different from either inflation or deflation. As the government struggles desperately against this current economic contraction, we believe its efforts will produce a combination of the negative effects of inflation and deflation, identified as stagflation.

Now, on to the arguments for our clients who are curious, engineers, and/or bored...

Defining the "flations"

In simplest form, inflation and deflation refer to the expansion (inflating) and contraction (deflating) of our money supply as well as many of the economic effects that result from these increases and decreases. Think of money supply as all of the cash you have in your pocket and in your savings/checking accounts at the bank (or under the mattress, depending on your view of the current banking industry!) added to all of the credit that is currently extended to you (home equity, credit cards, business lines of credit, etc.). So, in basic terms, all of our country's cash + credit = total money supply.

Inflation occurs when the money supply increases, meaning that people have more dollars in their pockets and their credit lines have been increased.

Deflation occurs when the money supply decreases, meaning that people have fewer dollars in their pockets and their credit lines have been decreased or cut altogether.

Cause and Effect: The Chain Reactions of Inflation and Deflation

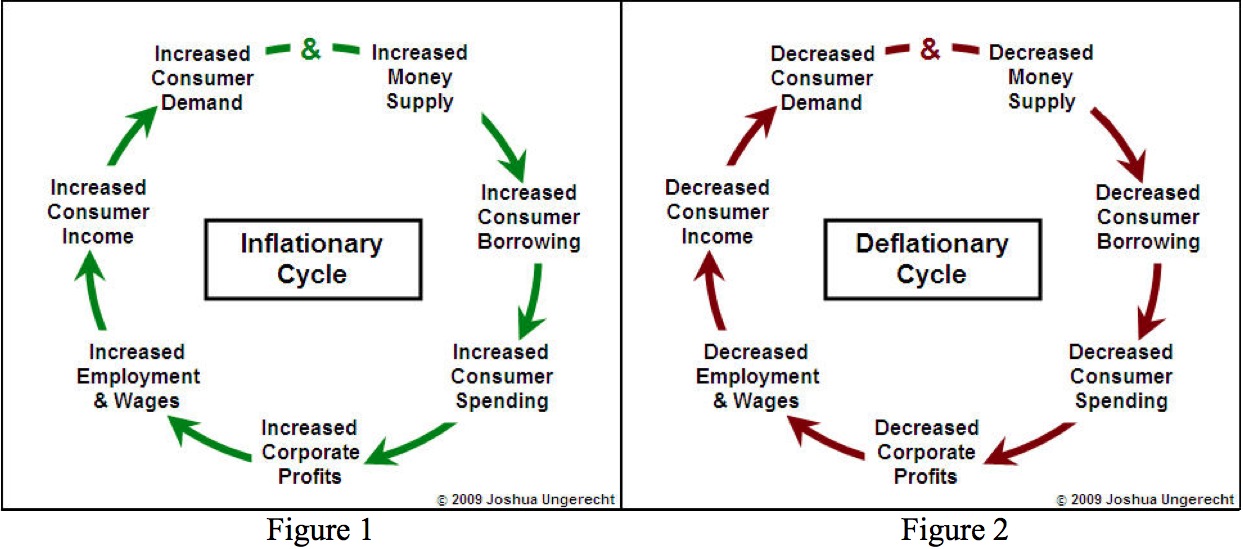

As depicted below in Figures 1 and 2, the effects of inflation and deflation are realized when the demand, borrowing, and spending habits of consumers rise or fall in concert with the increase or decrease in the money supply.

Inflation

If both consumer demand and money supply increase, inflation sets in and results in higher prices and reduced purchasing power because you have more dollars chasing the same amount of goods. Companies creating products and services enjoy bigger profits because of higher prices and are motivated to expand operations to meet rising consumer demand. As companies expand, employment is increased as well as competition between companies to obtain employees. Therefore, wages increase to secure current and additional employees. This results in increased consumer income, which then feeds right back into the cycle with an increase in consumer demand, money supply, borrowing, and spending, etc..

Buying Power vs. Dollar Supply: When inflation sets in, buying power decreases, meaning that each dollar you have in your pocket and at the bank eventually becomes worth a lot less and is able to purchase a lot less. That being said, in an inflationary environment, the typical consumer tends to have more dollars and more credit. So, the drop in buying power and the increase in prices are somewhat offset by the increase in consumer dollar supply. Much along the lines of boiling a live frog, if it happens slowly enough, inflation can occur and escape the notice of the general consumer.

Government and Taxes: Though most governments will take the position that inflation is an economic phenomenon they want to avoid or reduce, the reality is that most governments (including our own) love inflation--as long as it does not get out of hand and turn into very high or hyperinflation. If consumer incomes, prices, and corporate profits increase, tax revenues also increase. At the same time, in an inflationary environment, each dollar's worth and purchasing power is decreased, decreasing the cost of the government's debt. So, at the same time it becomes cheaper to pay past debt obligations, there is also an abundance of dollars, which makes dealing with the debt burden much easier.

Deflation

If either consumer demand or the money supply decreases, deflation sets in and results in lower prices and increased purchasing power because you have fewer dollars chasing the same amount of goods. Thus, it takes fewer dollars to buy the same product. The companies creating the products suffer lower profits because of lower prices and are motivated to reduce operations in light of falling consumer demand. As companies contract, employment is decreased and employees are now in competition to obtain employment. Therefore, wages decrease for current and additional employees. Moreover, the stocks of these companies drop with lower profits and decreased growth. This results in decreased consumer income and net worth, which feeds right back into the cycle with a decrease in consumer demand, money supply, borrowing, and spending.

Buying Power vs. Dollar Supply: When deflation sets in, buying power increases, meaning that each dollar you have in your pocket and at the bank eventually becomes worth more and is able to purchase more. On the other hand, in a deflationary environment, the typical consumer tends to have fewer dollars and less credit. So, the increase in buying power and decrease in prices are largely offset by the decrease in consumer dollar supply. Unlike inflation, deflation does not occur largely unnoticed. In practical terms, a drop in wages, loss of employment, or decrease in net worth has substantially negative effects on the consumer and dramatically decreases demand, borrowing, and spending habits.

Government and Taxes: Governments cannot stand deflation. If consumer incomes, prices, and corporate profits decrease, tax revenues also decrease. At the same time, in a deflationary environment, each dollar's worth and purchasing power is increased, so the government's debts actually increase in cost to maintain and pay down. Thus, there is an increase in the cost of debt at the same time that there are fewer dollars with which to pay off the past obligations, making the debt burden extremely difficult for the government to handle.

Stagflation: When the government fights deflation with inflationary policy.

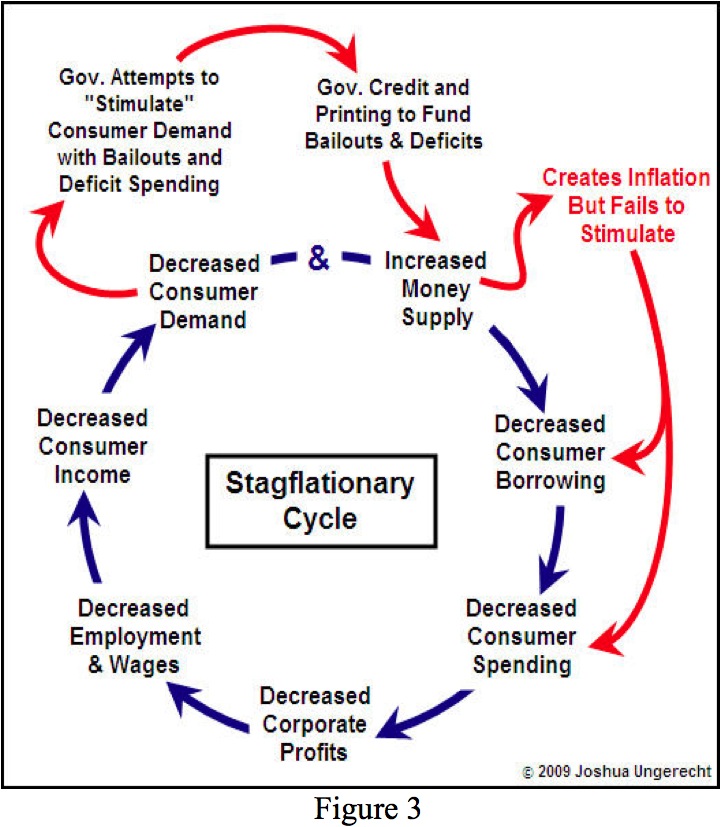

As depicted in Figure 3, stagflation mirrors many of the same effects as deflation with the exception of the government-driven inflation of money supply. It is important to note that simply increasing the money supply without increasing consumer demand does not result in some of the positive effects that accompany inflation.

Stagflation is the combination of deflationary economic stagnation/ contraction AND inflation of the money supply at the same time. Stagflation occurs when the government attempts but fails to reverse an economic downturn by inflating the money supply.

The result is a depressed economy AND a devalued currency.

What May Be Coming Down the Road...

In summary, we face two powerful, opposing tensions. On one hand, we have deflation, which is driven largely by shrinking consumer credit, demand, and spending. Corporate profits have suffered significantly, layoffs and bankruptcies have followed, wages have been cut, and consumer incomes are reduced. Prices of just about every product and service in every sector have been reduced considerably.

On the other hand, we have a desperate government determined to avoid deflation at all costs. Ben Bernanke, the current Chairman of the Federal Reserve, said recently,"We are currently being very aggressive because we are trying to avoid... deflation." (from Bloomberg) "Very aggressive” may be an understatement. The Federal Reserve has expanded its balance sheet over $2 trillion dollars to buy distressed assets (translation: created credit/money out of thin air). Most recently, the Federal Reserve committed initially to buying over $300 billion dollars of our government's debt (translation: we printed money to buy our own debt). Indeed, these measures are highly inflationary.

The result? Continued economic decline and a devaluing dollar (stagflation). The solution? Next letter.